Benefit Year Vs Calendar Year – The initial deadline to complete an audit for Form 5500 Annual Return/Report of Employee Benefit Plan is quickly approaching on July 31, 2024, for companies that have calendar year plans. Meanwhile, . States typically use similar unemployment insurance overpayment recovery methods in cases of both fraudulent and non-fraudulent payments. States primarily use the following overpayment recovery .

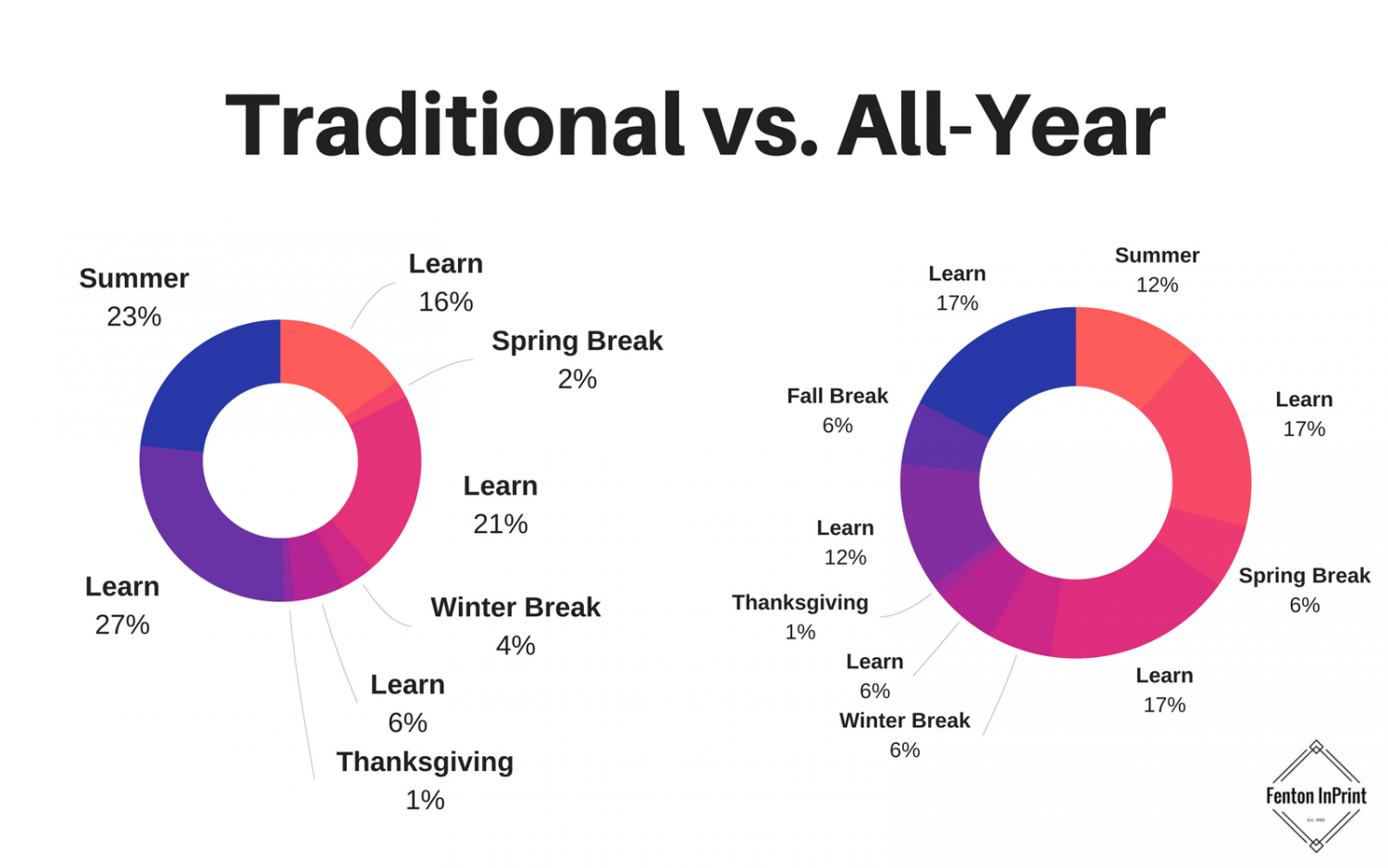

Benefit Year Vs Calendar Year

Source : fentoninprint.com

Policy Year Vs Calendar Year

Source : roster.assurances.gov.gh

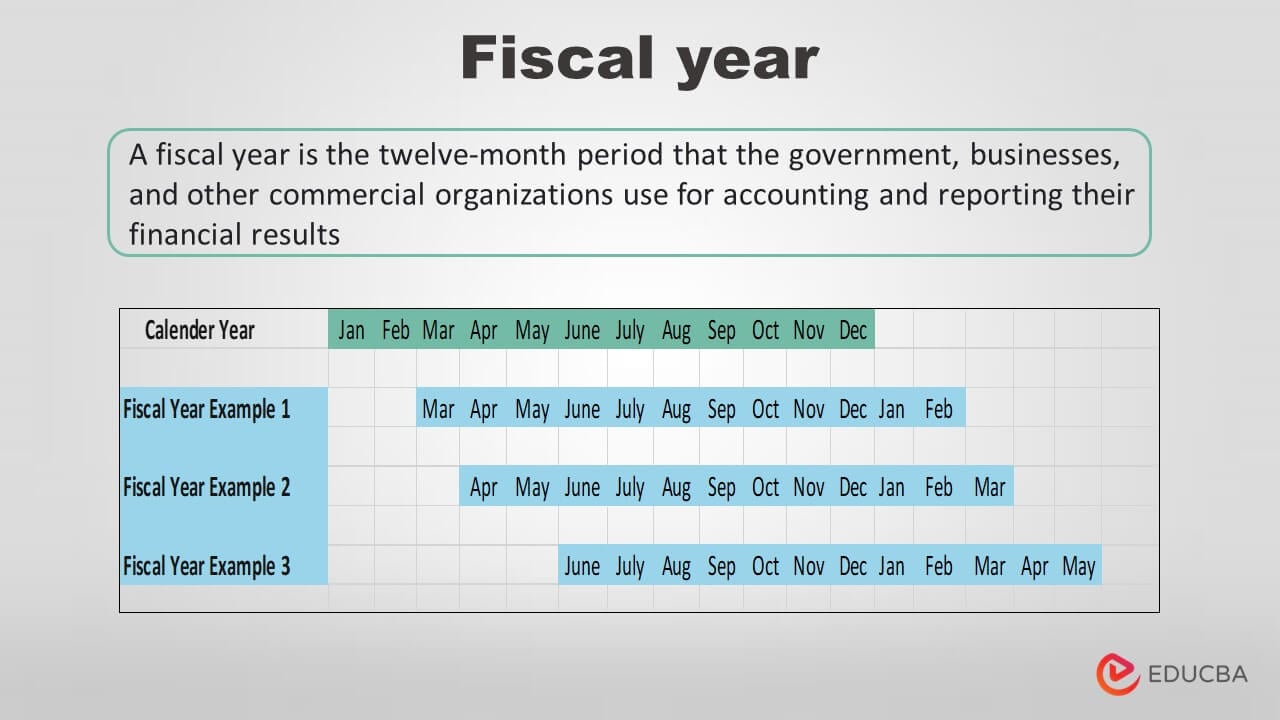

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

What is a Fiscal year? Benefits, IRS Guidelines, & Examples

Source : www.educba.com

Calendar Year vs. Plan Year Deductible Health Benefits Associates

Source : healthbenefits.net

What Is a Fiscal Year?

Source : www.thebalancemoney.com

What Is Fiscal Year End? Definition and vs. Calendar Year End

Source : www.investopedia.com

Fact Sheet: Voucher Dollars Take from the Many to Benefit the Few

Source : gbpi.org

What Is the Tax Year? Definition, When It Ends, and Types

Source : www.investopedia.com

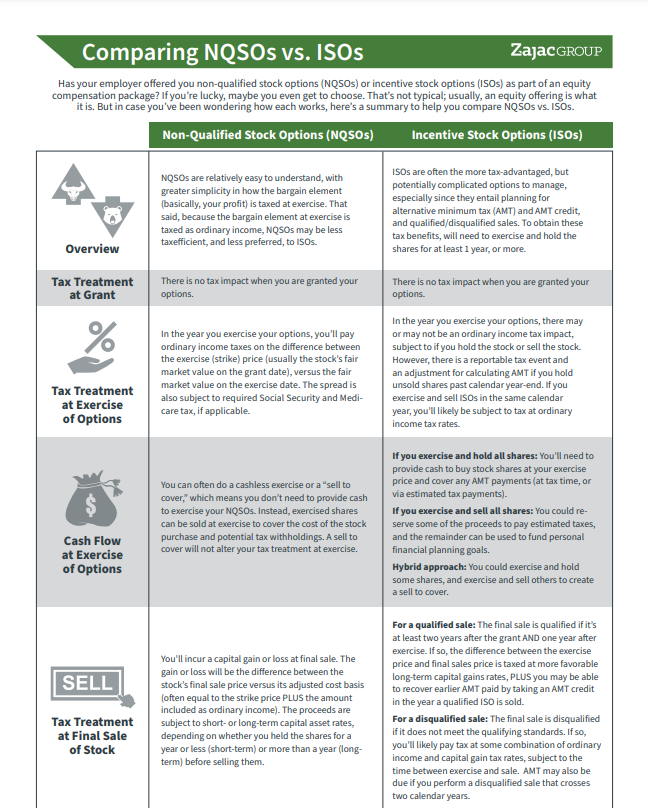

Choosing Restricted Stock Units vs Non Qualified Stock Options

Source : zajacgrp.com

Benefit Year Vs Calendar Year All year schooling should replace ten month calendar to benefit : Timeline presentation for 12 months, 1 year, Timeline infographics design vector and Presentation business can be used for Business concept with 12 options, steps or processes. Calendar day 29 . The AARP estimates that one out of seven retired people 65 and older depends on Social Security for almost all of their income. If that’s you, we understand it’s especially important to you to know .

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

:max_bytes(150000):strip_icc()/fiscal-year-definition-federal-budget-examples-3305794_final-c54e01b8314f424a8aefacb8c126d192.png)

:max_bytes(150000):strip_icc()/FiscalYear-End_v1-e3337960a07c4b9f9a9d394e934caca2.jpg)

:max_bytes(150000):strip_icc()/taxyear-c3f5618cd504499583b0543cb4d6b31e.jpg)