Roth Ira Calendar Year – A Roth IRA rollover or conversion shifts money from Note that the rollover is considered to have been made at the beginning of the calendar year in which the rollover is complete. . who campaigned for years on a new individual retirement account that wouldn’t be taxed upon account distributions. Here’s a closer look at what a Roth IRA can do for you. Roth aimed to put .

Roth Ira Calendar Year

Source : www.biglawinvestor.com

Roth IRA 5 Year Rule Explained

Source : www.trustetc.com

What Is a Roth IRA Conversion? | The Motley Fool

Source : www.fool.com

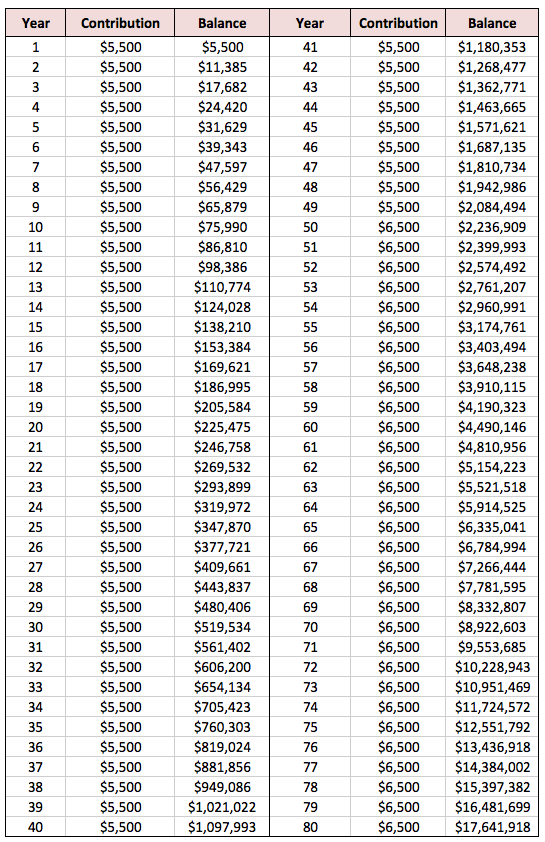

Contributing to Your IRA | start early, know your limits | Fidelity

Source : www.fidelity.com

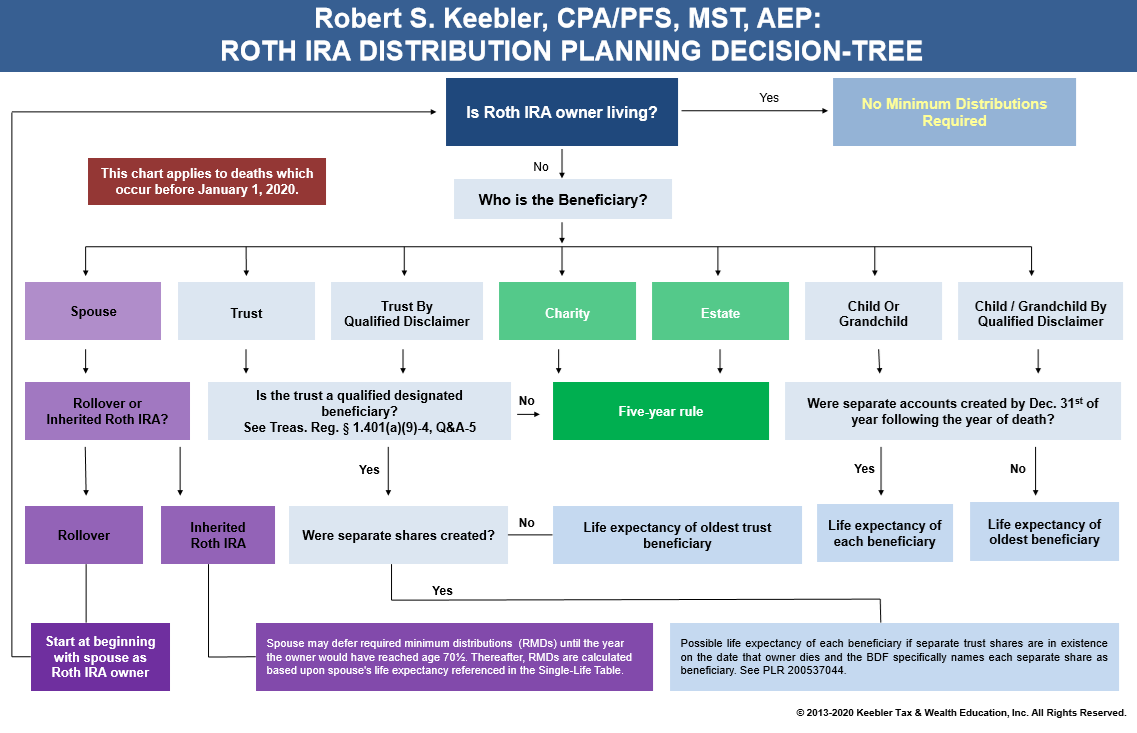

2024 Roth IRA Distribution Chart Ultimate Estate Planner

Source : ultimateestateplanner.com

Systematic Partial Roth Conversions & Recharacterizations

Source : www.kitces.com

Roth IRA 5 year rule explained

Source : www.usatoday.com

2024 Contribution Limits: 401(k), Traditional & Roth IRA

Source : www.britannica.com

IRS Unveils Increased 2024 IRA Contribution Limits

Source : www.theentrustgroup.com

How to Do a Backdoor Roth IRA [Step by Step Guide] | White Coat

Source : www.whitecoatinvestor.com

Roth Ira Calendar Year Secrets of a $100,000,000 Roth IRA – Biglaw Investor: If you age 50 or older you can make catch-up contributions to a Roth IRA each year. There is an allowable Roth IRA catch-up contribution of $1,000 per year for those who have reached the age of 50 . What is a Roth IRA? Roth IRAs are individual retirement accounts “Another cool thing about a Roth is that you have until April of the following year to see if you are eligible to contribute .